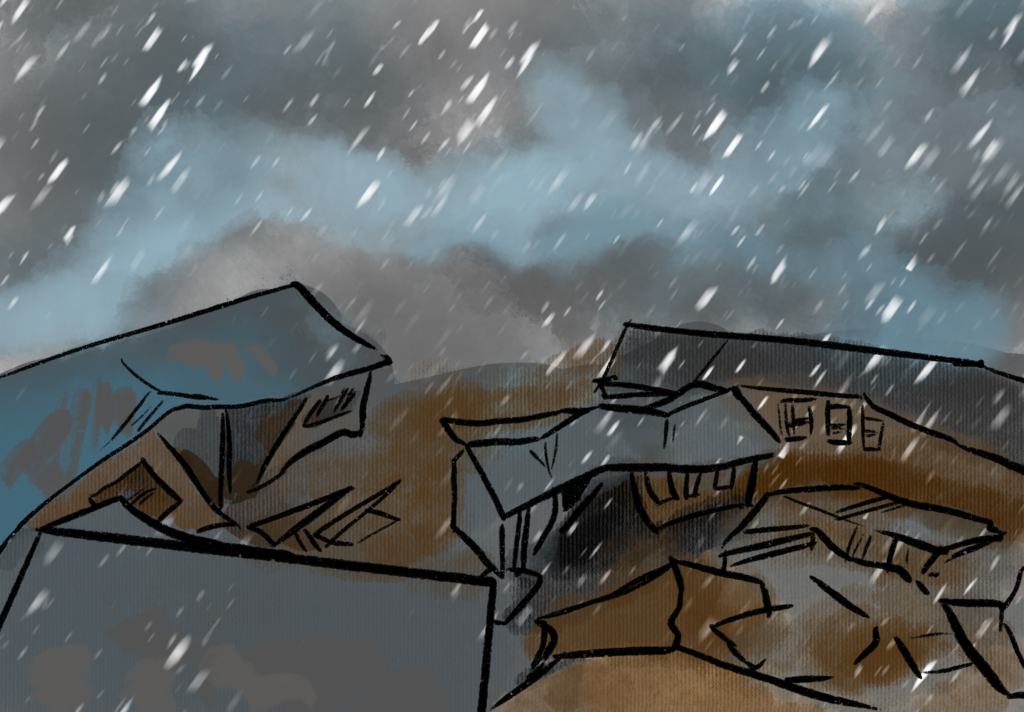

Graphic by Evelyn Kim ’25/The Choate News

By Zaki Shamsi ’26, Opinions Writer

In the aftermath of Hurricane Helene, one thing is painfully clear: our insurance system is broken. When I say broken, I don’t mean the kind of broken that you can fix with a little duct tape. I mean a full-scale catastrophe that leaves people abandoned in their times of greatest need, watching as their livelihoods are swept away. Insurance companies have mastered the art of collecting premiums and denying claims, while those caught in the crossfire of climate disasters are left to fend for themselves.

Take the aftermath of Hurricane Harvey in Texas as an example. Thousands of homeowners discovered too late that their policies didn’t cover flood damage, even though flooding was responsible for 90% of the storm’s destruction. The National Flood Insurance Program (NFIP) offers flood protection, but less than 20% of homes affected by Harvey had this coverage. Hurricane Helene is a carbon copy of this failure, with inland areas like Asheville, North Carolina, seeing massive devastation — yet under 1% of homes there carried flood insurance. In Asheville’s Buncombe County alone, 17 homes are at risk in a 100-year flood event for each home insured against it. People simply aren’t being covered where it matters most.

Now, let’s be clear: hurricanes don’t care about your financial status. They don’t check your zip code or your insurance policy. But when the winds calm and the floodwaters recede, it’s the poorest among us who are left standing in the rubble, with nothing but empty promises from an industry designed to profit off of their misfortunes. After all, it’s not a disaster for the companies who jack up rates, limit coverage, and then walk away like nothing happened. In 2022 alone, U.S. property insurers recorded $15 billion in profits, as rates for consumers rose by an average of 15%. Some companies, like Farmers Insurance, have even begun pulling out of high-risk hurricane states like Florida, abandoning vulnerable households and residents.

The real scandal here is that the government, the one entity with the power to step in, has chosen not to. Politicians wring their hands about the tragedies unfolding on the news but do nothing to regulate these corporations. Instead, they leave it to market forces, as if profit margins and corporate shareholders can rebuild a life, replace family heirlooms, or erase the trauma of watching everything you own wash away. Over 20 insurance companies in Louisiana went bankrupt or fled the state after hurricanes Laura, Delta, and Ida, leaving thousands of Louisiana residents without insurance protection.

The government is complicit in this disaster by failing to regulate the insurance industry. Hurricane Helene is only a preview of what’s to come. As climate change intensifies, storms are expanding their reach inland, and previously safe areas are now marked as “disaster zones.” Scientists at Lawrence Berkeley National Laboratory estimate that global warming increased Hurricane Helene’s rainfall by up to 50%, turning inland rivers into torrents that destroyed towns far from the coast. But those in power act like this is business as usual — it’s not.

We need reforms that ensure affordable, comprehensive coverage for all people, especially those in high-risk areas. The Federal Emergency Management Agency’s National Flood Insurance Program needs expansion, and insurance companies must be required to cover climate disasters without loopholes. The inability to achieve this promise is a moral failure. Without these changes, we’ll continue to see a growing divide between those who can rebuild and those who are left to pick up the pieces alone — victims not only of natural disasters but also of a system designed to let them fall through the cracks.